UC Investments

Frequently asked questions

- What is the overall strategy of the University of California Retirement Plan (UCRP)?

- What is asset allocation?

- What is the "efficient frontier"?

- How is a new asset class implemented?

- How are the expenses of the UC-managed funds kept so low?

- What is "risk management"?

- What is "active risk"?

- What are alternative investments and why are they beneficial?

What is the overall strategy of the University of California Retirement Plan (UCRP)?

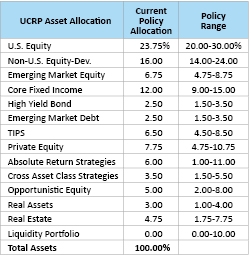

The UCRP utilizes a moderate growth strategy which attempts to limit volatility. The Regents adopted the following asset allocation policy in March 1, 2013, with adjustments toward long-term targets. The current policy allocation is pro-forma on July 1, 2013, policy allocation.

What is the UCRP policy if an asset class moves outside of the allowable range?

Staying balanced helps avoid unintended risk. Adherence to the designated plan helps the staff avoid the temptations of market timing and chasing returns, both of which can position the overall portfolio to underperform when market conditions change.

The Office of the Chief Investment Officer of the Regents monitors asset allocation compliance within the allowable ranges on a daily basis. In those circumstances where the asset allocation is outside the allowable ranges, according to The Regents’ directive, the Office of the Chief Investment Officer takes the investment actions necessary to rebalance assets to the policy allocations in a timely and cost effective manner. Under normal circumstances, rebalancing is completed within one month.

What is asset allocation?

Asset allocation is the process of dividing the investments in a portfolio among different asset classes such as equities, fixed income securities and cash to optimize the risk/reward trade-off based on an individual's or institution's specific situation and goals. Resulting strategies can range from very aggressive to very conservative.

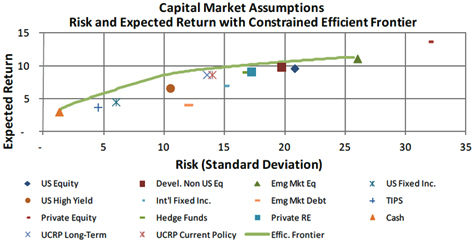

What is the "efficient frontier"?

The "efficient frontier" is the line on a risk-reward graph comprised of "efficient" portfolios. Efficient portfolios are those that provide the greatest expected return for a given level of risk or, conversely, have the least risk for a given level of return. Given the constraints mandated by our asset allocation guidelines, the Office of the Chief Investment Officer structures and modifies each fund so it moves closer to the efficient frontier. See the example below.

How is a new asset class implemented?

New asset classes are implemented upon approval by The Regents; however, the Office of the Chief Investment Officer may choose to wait or may proceed slowly if market conditions warrant. Asset allocations are fulfilled in a manner benefiting long-range performance of the portfolios.

How are the expenses of the UC-managed funds kept so low?

We retain a relatively small but experienced investment staff and our large asset size allows us to utilize economies of scale and negotiate cost-effective contracts for any outside services. We also work closely with UC Human Resources and Benefits to keep administrative costs associated with UC-managed funds utilized within the 403(b) and Defined Contribution plan accounts low.

What is "risk management"?

All investment portfolios—endowments, individual retirement accounts, savings earmarked for a down payment on a home—have a more or less specific investment objective. A defined benefit pension plan, such as the UCRP, has a well-defined objective: to pay the retiree benefits which are promised to employees by the employer. The approach to risk management is similar across all portfolios: establishing measurement and monitoring processes to ensure that the investment policies and strategies are being implemented effectively in order to increase the probability of success and limit losses to an acceptable level.

For the individual portfolios that make up the pension fund, the focus is on whether they have are tracking their benchmarks and how much risk they are taking in order to add incremental value over the benchmarks. Monitoring portfolios on a daily and monthly basis, and ensuring that guidelines are being followed and risk budgets are not exceeded, is one side of risk management. This process is appropriate for any portfolio. Pension risk management has an additional component. This is due to the contractual nature of the pension promise and the requirement to make payments according to a defined schedule. This necessitates careful analysis of liquidity and the maintenance of a liquidity buffer.

What is "active risk"?

We use the term “active risk” as a measure of how “different” the portfolio is from the benchmark. To be precise, it is a measure of the likely range of active returns around the benchmark. Active risk results from any difference in the individual securities and weighting of securities between a portfolio and benchmark, for example, over- or under-weighting securities, industries, sectors, countries, regions, currencies, styles, capitalization size, etc. Of course, portfolio managers take active risk—i.e., they have exposures different than the benchmark—to earn positive active returns. And all else equal, expected active return is proportional to active risk (the size of the differences). Thus risk (difference from benchmark) is the “input” to the investment process, and should be carefully measured and managed. If we can measure, in some sense, the potential return impact of each of these decisions, then we can begin to manage risk. In addition, if we understand how much risk is contributed by different parts of a portfolio, we can build a better diversified portfolio.

Managing investments has always been about managing risk, and this has traditionally been done by investment guidelines and constraints. For example, there may be limits on individual security weights, or the absolute weight of a sector, or a limit on non-core investment in “risky” sectors, such as high yield bonds or emerging market stocks.

Why is this approach inefficient? These constraints help us limit risk (they are crude, but sometimes effective, risk controls). But they do not help us tomanage risk. When we apply these constraints, we can’t be sure how much risk we will have – any more than we know how much risk results from a 50% allocation to active strategies. Do we have too much or too little risk? The latter could be as much of a problem as the former if the risk we take is not commensurate with our expectations for higher returns.

What are alternative investments and why are they beneficial?

"Alternative investments" (AI) is a broad label used to describe asset classes and investments other than traditional equity or fixed income. Alternative investments include private equity; hedge funds; foreign exchange investments; real estate; and commodities, including natural resources and agriculture. AI have become increasingly recognized as providing diversification benefits to a traditional portfolio and are now considered to be a core investment category for many institutional and private investors.

Research shows that effective reduction of risk in an investment portfolio comes with investing in assets that do not exhibit the same pattern of performance. A low correlation between returns on different asset classes indicates that the performance of those assets is not closely related. Because the performance of AI strategies tends not to be highly correlated with that of traditional equity and fixed income markets, investing in AI can be a means of diversifying a pool of assets and lowering the overall portfolio risk (volatility). Lower portfolio volatility can result in higher risk-adjusted returns—that is, the size of return achieved given the level of risk assumed. The University of California is among the growing number of institutions that have added Alternative Investments to their portfolios or increased and expanded upon existing allocations. The UC AI portfolio currently includes private equity, hedge funds, real estate, and other real assets.